Do you know about Customer Lifetime Value (CLV)?

What is Customer Lifetime Value(CLV)?

Customer

Lifetime Value(CLV) is a metric that indicates the total revenue a business can

reasonably expect from a single customer account throughout the business

relationship.

Why it is so important?

·

It tells that how valuable a customer is to your business.

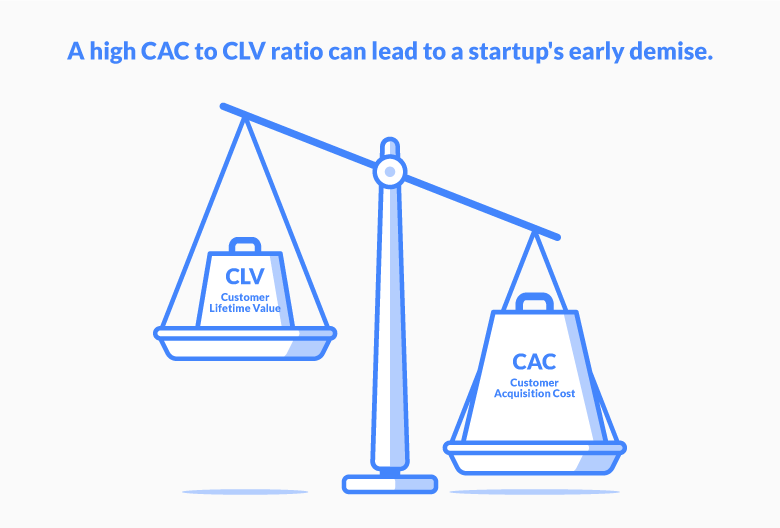

If a business is spending too much

money on customer acquisition costs (CAC), but its customers are not profitable

for the business, then it leads to losses which definitely affect the business.

Once we calculate CLV, we can focus on optimizing this ratio which ensures that

our business continues to grow at a healthy rate.

Why it is so important?

· It tells that how valuable a customer is to your business.

If a business is spending too much money on customer acquisition costs (CAC), but its customers are not profitable for the business, then it leads to losses which definitely affect the business. Once we calculate CLV, we can focus on optimizing this ratio which ensures that our business continues to grow at a healthy rate.

How to Calculate Customer Lifetime Value?

Several

distinct strategies exist to compute CLV. The way in which we calculate

customer lifetime value can likewise fluctuate in view of our business model.

For example, it's simpler to compute CLV assuming we have a membership model

than we you're in a web-based business. That is on the grounds that deals

become more prescient. Before we start calculating CLV, there are a few things

we need to know:

1) Average Purchase Value It is the average value of the customers' transactions.

For example, I have the dataset which contains the variable Unit Price and Quantity of products a customer bought. So, I calculated the total transaction value or purchase values of each customer. I used the R Studio to perform these calculations. Firstly, I multiplied the Unit Price with Quantity to find the total amount of each transaction. Secondly, I used the group by and summarize function to find purchase values for each customer. And lastly, I found the mean of all customers' purchase values.

By

performing these steps, the average purchase value for this dataset came to

be 2229.076

2)

Average Purchase Frequency

This is

the average number of transactions a customer makes over a given time period.

Purchase frequency can be calculated by dividing the average number of purchases

by the average number of customers.

For

example, I

used invoice date and invoice no of each customer in this example dataset to

find the average purchase frequency. For this, I used the strptime and

lubridate functions because R by default treat every character as string ,

strptime function is used to tell R to treat invoice date column as numeric

also by specifying format and lubridate function makes data and time easy read.

Furthermore, I did some cleaning of dataset by using drop_na function which removes

empty observations. Finally, I calculated the average number of purchases

by using InvoiceNo variable (n_distinct for counting unique InvoiceNo and

summarise for aggregating the mean of total transactions of all customers).

By performing these steps,

the average purchase frequency for this dataset came to be 1.622669 which means customers on average do

1.622669 number of transactions during the particular period of time (whole

period in this case).

3) Average Customer Lifespan

This is the average time of customer

relationship. In other words, it is the average number of days between

first order date and last order date of all of our customers. A business that

retains its customers well may have a customer lifespan of 5 years, while one

that isn’t good at retaining its customers may have a lifespan of 6 months, or

0.5 years.

For

example, I again used the invoice

data variable, which refers to the transaction date, to calculate the first

transaction and last transaction date of each customers by using max, min, and

difftime functions in R Studio. The unit of lifespan I used here is days which

then I converted into months. Finally, I calculated the mean of all customer's

lifespan.

By

performing these steps, the average customer lifespan for this dataset came to

be 4.131717 which means a customer stays with us on average

4.131717 months.

4) Average Gross Margin

Gross Margin tells you what part of

each customer purchase is profit and what part is cost. Average gross margin

can be calculated with the following formula:

Average

Gross Margin = (Total Revenue – Cost of Sales) ÷ (Total Revenue)

For

example, the average

gross margin for the previous example dataset, which we calculated by the above

formula, is 0.3

5)

Customer Acquisition Cost(CAC)

We have already discussed it that it

is the average amount you spend on acquiring a customer, and includes

everything from marketing and advertising.

For

example, lets

consider the CAC for the example dataset 5000.

General Formula

to calculate CLV

Once we have the above information,

calculating CLV is easy. Just multiply our average purchase value with average

gross margin, purchase frequency, and customer lifespan. Finally, subtract with

cost of acquisition(CAC).

CLV

= (Average Purchase Value × Gross Margin × Average Purchase Frequency × Average

Customer Lifespan) – CAC

For

example, lets put the

values we calculated from the previous dataset in this formula:

CLV = (2229.076 × 0.3 × 1.622669 × 4.131717) - 5000

CLV = 4483.391 - 5000

CLV = 516.609

which means that the total revenue a

business can reasonably expect from a single customer is 516.609. However, if our CLV is negative

then customers are costing you more to serve than customers are making you

in revenue, so we can actively work to stop selling to those customers.

I hope this reading would provide a better understanding of Customer Lifetime Value.

Thanks for reading.

- Muhammad Tayyab

- Mar, 27 2022